Leipzig Prices in 2016

Our View on Property Prices in Leipzig in 2016

What will the Property Prices be in Leipzig in 5 Years? We get out the Crystal Ball..

We have written recently of historical house prices in our key markets in Germany, made reference to some of the markets that yield investors are looking at currently and discussed matters of the Euro and the likely effect on values in Germany. In this short article, we will look at the key drivers to property price appreciation and their impact on our key market of Leipzig in Germany.

Some of the key factors which will effect capital values in the next 5 years in the market can be listed as follows:

1 Investor confidence

2 Investor access to finance and finance rates

3 Rental level development

4 Owner-occupation levels

5 Recent capital value trends

6 Affordability

1 – Investor Confidence

One of the hardest factors to pin down and time, but perhaps the biggest factor when it comes to the driving of capital values upwards or downwards. One of the key determinants of confidence within a market is the likely future demand placed for property, and the prime driver for this is a city’s population level. Within Leipzig, the population famously fell soon after the wall came down in 1989, but has recovered to a great extend over the past few years. A table of population in Leipzig is given below:

| Year | Population |

| 1990 | 511079 |

| 1991 | 503191 |

| 1992 | 496647 |

| 1993 | 490851 |

| 1994 | 481121 |

| 1995 | 470778 |

| 1996 | 457173 |

| 1997 | 446491 |

| 1998 | 437101 |

| 1999 | 489532 |

| 2000 | 493208 |

| 2001 | 493052 |

| 2002 | 494795 |

| 2003 | 497531 |

| 2004 | 498491 |

| 2005 | 502651 |

| 2006 | 506578 |

| 2007 | 510512 |

| 2008 | 515469 |

| 2009 | 518862 |

| 2010 | 522883 |

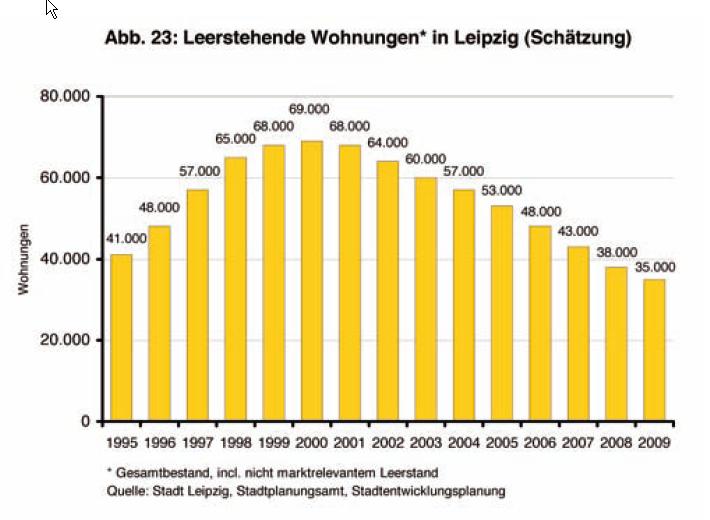

The city has seen a return to growth from 2001, and the rate of increase over the past decade has been one of the highest in Germany. Average estimates are now for 2025 at 538,000 inhabitants, with a high-end estimate of 565,000 by that time. The table below shows the corresponding fall in vacant units in Leipzig, having over the last decade. Investor confidence comes from every one of the following key drivers, but with a strong population growth story in Leipzig, it augers well in terms of under-pinning growth in the coming years.

Right now, an investor feels rightly rewarded with a net yield of between 7-11% in the Leipzig market. With interest rates for 5-10 year fixes at around 4%, there is still room for an increase in confidence pushing yields further down. Yields in a stable market would equate to around 2% over lending-rate, so around 6%. Should yields drop due to this increased buyer confidence, then prices have the capacity to rise by around 40%, should finance remain low.

2 – Investor access to finance and finance rates

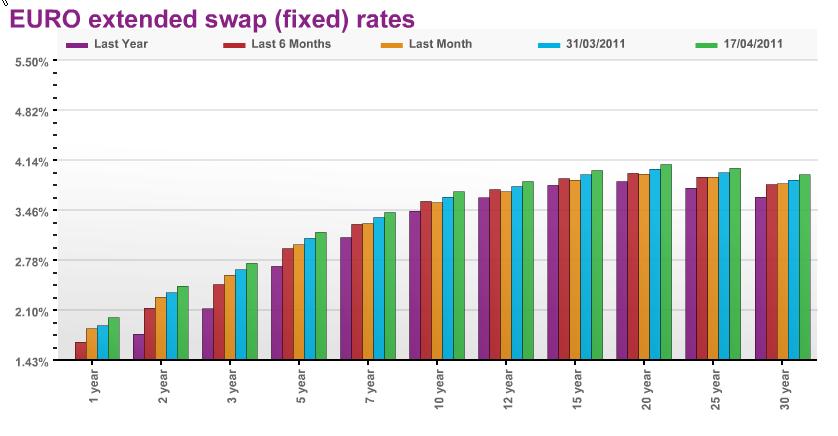

Finance is readily available for both international investors and domestic investors, the latter enjoying very high levels of liquidity up to 100% of the property value. Whilst fixed rates loans are marginally up from their lows of 2009, they are still at near historic low levels for the Euro.

The Table above shows 5 year money for example at an interbank rate of around 3% meaning finance is available to investors for this duration at around 4 to 4.3%. Whilst finance rates may well edge upwards in the coming years, the curve on the above graph, the so-called yield curve, shows interest rate expectations are not showing significant climbs and still below long term norms. In terms of liquidity, bank lending has proved robust through the most significant bank crises for generations, and shows no signs of abating. Current lending levels to foreign investors are around 60-80%, depending on the project and the investor. These levels have remained reasonably intact through the financial crisis, and should remain for investments where rents cover finance payments by at least 125%, so called “rental coverage”. Currently, rental coverage is often 200% or more, so there seems no immediate threat to tightening financial conditions.

3 – Rental level development

Increasing rent levels are the typical trigger for capital appreciation in the more mature markets in Germany. As rents creep up 5% or so per year, so the capital value increases by the same amount, all other things being equal. The current rent levels in Leipzig are very low and have remained so for the last 10 years or so, whilst excess capacity has been worked through with the increase in population or through demolition of unrefurbished stock. The dramatic falls in vacancy levels of apartments is shown below:

This graph shows vacant units falling from a high in 2000 of 69.000 to a level of 35.000 in 2009 and it has continued to fall to 2011.

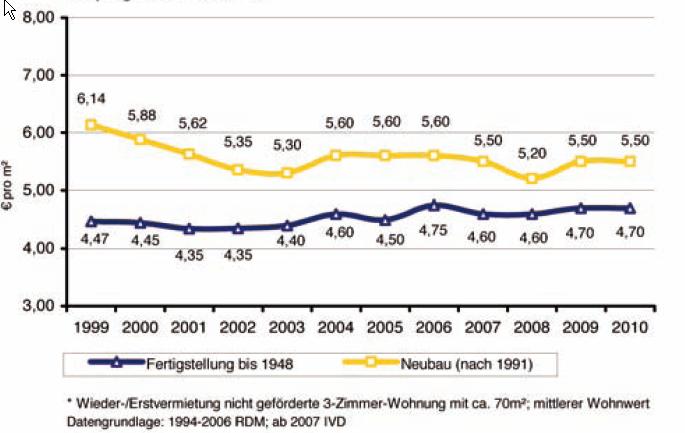

Rental levels have remained fairly static over this period as tenants have enjoyed competitive pressure on landlords, as the graph below shows:

This graph shows the price per sqm that can be charged for a typical 70 sqm apartment, the blue line showing the price for older period buildings which are typical for our investors. The rate of rent has barely moved in a decade. There is real pressure on this situation, as the German economy improves and net income for Leipzigers increases. A return to a link with rpi for rents shold be expected at the very least. But the big impact of late was the government decision to increase the rate of rent paid for social tenants [those in receipt of income support] by 10% overnight to a level of 4,22 Eur per sqm. This will have a ripple through effect on the whole market and rent will develop across the board, perhaps higher once the latent rental increases of the last decade are increasingly realised.

The effect on capital values will be that sellers will increase prices in line with rents, this being how property is valued by surveyors and banks. A likely increase in capital values of at least 10% due to rent increases over the next 5 years should be experienced.

4 – Owner-occupation levels

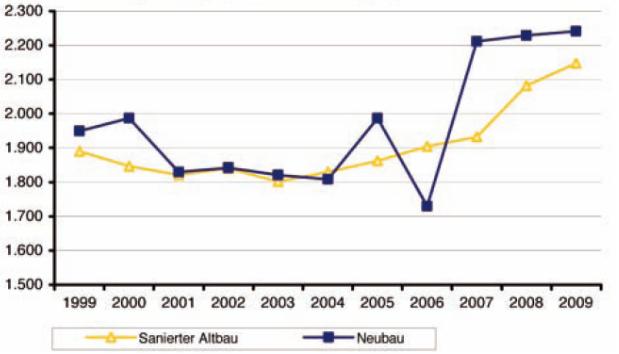

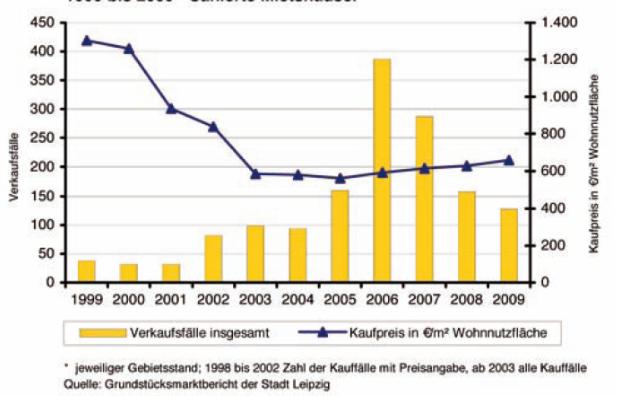

Finally, and perhaps of greatest interest, is a fairly unique feature of this market. In 1989, all property was held by the state and before the wall fell every inhabitant of the city was effectively a council tenant. Since that time, owner-occupation has risen steadily to around 15% today in the city of Leipzig. Some may wonder why this has not risen quicker, particularly with the low capital values of recent years. An answer to this lies in the appetite and culture of those with sufficient funds to buy their own home in the last 20 years. Typically, it is those aged around 25 years old or more that aspire to home ownership. It has taken some time for the lack of a housebuying culture to work through the older generation and arrive in a new generation with funds to buy. For sure, many of today’s 25-35 year olds aspire to own their own place, much in the same proportion to the rest of Germany where average owner occupation is just below 50%. Today, it is typical for out of town suburbs with new build single family houses or the very best areas of town in apartment houses to support this growing sector. The real point to note is the typical much higher price paid by an owner-occupier to an investor of a complete apartment house. The property is not purchased on a yield-return basis, more on the ability to pay and service the mortgage through income. So, areas in Leipzig where owners occupiers are buying their own apartments are typically paying from 1.200 Eur as a very minimum to 3.000 Eur per sqm or more. This is between 2-3 times investors buying apartment houses alongside them are paying. Quite an odd situation!! The graph below shows pricing history in Leipzig over the last decade for single apartments:

So, as owner-occupation increases to a more mature level towards 40%, so the average to good areas of the city will see viability for investors to divide their apartment houses into individual units and dispose of them, in a good refurbished state, to owner occupiers at a very significant uplift to the original price paid. In some areas, this may take 3-10 years to be a viable option, in other areas such as Gohlis South, Sudvorstadt and Schleussig this is an option to do right now. With current average prices for a multi-family house at around 700 Eur per sqm, the ability to derive capital growth from dividing and selling, where the area supports, is enormous. Right now, this strategy could deliver an uplift in capital value as compared to the purchase price of an apartment house by at least 50%, and often more in the best areas of the city.

5 – Recent capital value trends

Looking at the last decade for pricing of multi-family property, we see a sharp decline and stabilised situation of late:

The blue line shows the average price in sqm of a multifamily house in Leipzig, going from around 1.300 Eur per sqm in 1999 to just over 600 Eur per sqm in 2009. The yellow bars indicate transaction levels, with higher numbers running up to the global financial crisis, but still historic high levels in 2009 which have continued to rise in 2010. Whilst it is foolhardy to claim that capital levels will always return to a a level previously attained, the increased purchasing power a decade on, together with core inflation should drive pressure on multi-family prices in the coming 5 years, seeing perhaps a return to the 900-1100 Eur per sqm level, or around a 30% increase on today’s prices.

6 – Affordability

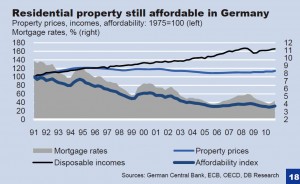

Whilst claims of future increases as we have made are all very well, but the key determinant must be affordability for owner-occupiers to service the debt positions. The collapse in the link with affordability in markets such as USA and UK in 2003-07, and the continued bank lending, was a major factor in the crisis which followed. The chart overleaf is from a Deutsche bank Report in April 2011.

The chart shows that affordability of German property as a whole is actually at its best in recent history. Low finance conditions, and the fact that Germany did not participate in the global property bubble [together with an increase in disposable income] has made German property now the cheapest it has ever been.

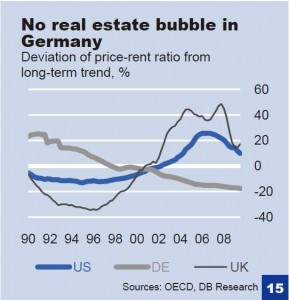

By another measure of price-rent ratio, we can see how Germany fares with UK and USA in terms of affordability:

Conclusion

Well, we do not often make claims for future capital prices at ProVenture, but hopefully we had given some kind of idea on the key drivers to prices over the next 5 years. Should the German economy continue to recover as it has done in the last 2 years, the drivers stated will all be well-supported and growth should eminate from all the points listed. So, you want to pin me to the wall I guess and ask me how much property will go up, don’t you? Well, to feed our chat in 2016, I will make the following predictions:

C-Grade Property – Location Where Tenants are Predominantly in receipt of “Social” rate

Here, I would expect a 10% increase to be priced in during 2011-2012 due purely to the change in social rent levels. I would expect the increase in population to drive demand for rental in these areas and vacancy to continue to fall. I would therefore expect the pricing due to lower vacancy and more sustained yield increasing by a further 10%. Finally, especially in areas which are on the “fringes” on B locations, I would expect investor confidence to increase such that the yield today of say 11% on purchase dropped to around 9%. All of these factors should combine to around a 40% increase in capital values in these types of areas.

B-Grade Property – A lower Proportion, if any Social Tenants and an “Average” Rental Structure

I would expect the factors above to impact on this sector, with yields today of 9-10% falling to 7-8%. Rental increases could outpace the C-located property after 2-3 years, as rental developments become the norm and supply is outstripped by demand. So overall, I would expect a 50% increase in capital values in these areas.

A-Grade Property – Where a Higher Proportion of Owner-Occupiers Live Now or Are Moving In

In addition to the factors above, I would expect multi-family apartment house buyers to increasingly take advantage of dividing the property into single apartments for onward sale to owner-occupiers or smaller investors. In some parts of the city, this could result in a dramatic uplift in value as the affordability for owner-occupiers is at a historical low, and capacity for prices to return to 1999 levels is very great. But I will err on the side of caution and suggest that investors in these areas will be able to enjoy a 50% uplift in their price if they divide their units on sale. So, combined, investors could achieve up to 100% increase in capital in these locations.

These are the types of increases our investors from 2007-08 have experienced so far, perhaps 40% on average, without many of the upward pressures on values that exist today [they just bought well].

Well, it is an interesting topic to take up over a beer with investors when we meet as the next 5 years unfolds. Wishing you all luck in this period!